Your financial future deserves a strong foundation. We're here to help you build it.

Most investors have access to a limited number of investment tools. Griffin Private Wealth Management invests like major pension plans so you can have peace of mind and confidence in the future.

Diversify Your Wealth

Mitigate Your Risk

Secure Your Future

Bringing Institutional Investment Strategy to Individual Investors.

We think of your investments as a mini-pension fund. For many investors, moving towards a pension-style investment philosophy fits nicely with their long-term goals and objectives.

Pension style investing can…

- Help grow your savings by focusing on a diversified portfolio.

- Help you manage risk by diversifying across a range of asset classes.

- Help you generate income in retirement.

- Help protect your purchasing power over the long term.

- Help you avoid making short-term investment decisions.

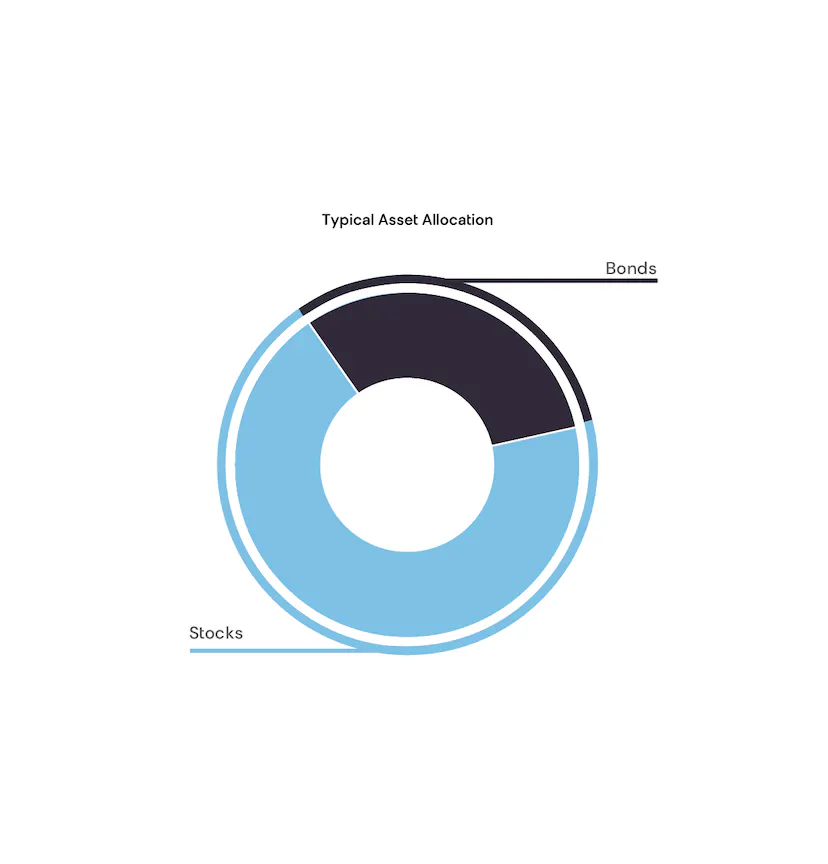

Outgrowing the 60/40 Portfolio

In today’s rapidly changing market, the age-old 60% stocks and 40% bonds strategy no longer suffices as optimal diversification.

Global markets and increasingly networked economies requires an approach that is not just along for the ride.

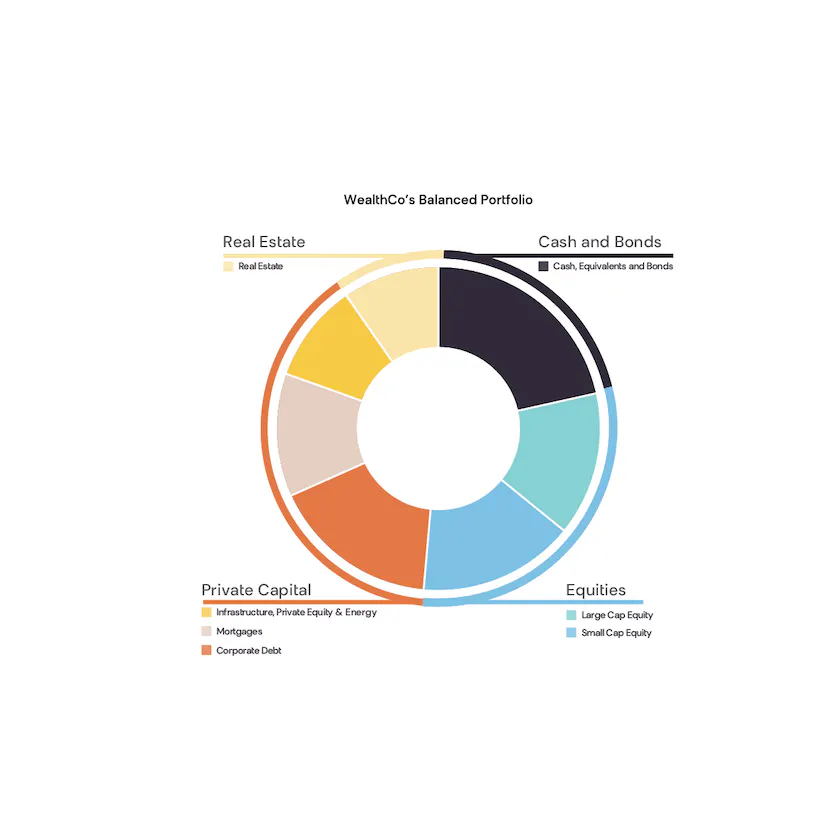

Next-Level Diversification: The Institutional Advantage

Large institutional investors like pension funds have largely outperformed traditional investing. Why? They’ve leveraged alternative investments.

Griffin Private Wealth Management embraces this pension-style approach to provide our clients with unique growth potential and an extra layer of diversification beyond the traditional asset classes.

Our value beyond the numbers

Griffin Private Wealth Management’s aim is to help you sleep better at night by offering you peace of mind. Here’s how.

An Integrated Approach

Formulate a plan that considers all aspects of your financial life and make better decisions by working collaboratively with all of your professional advisors

Capital Pooling

Capital pooling provides scale, diversification, and access to alternative investments not otherwise available on retail platforms.

Deeper Diversification

We provide you with a range of choices with flexibility and diversification otherwise not available in the retail market.

Peace of Mind

We strive to deliver above-average risk-adjusted returns. We’re more concerned about downside protection than upside capture.

First Class Sector Specialists

Our sub-advisors are experts in their niche, and offer you exposure to a diverse mix of alternative investments and traditional asset classes

Spectrum of Options

Experience the comfort of a portfolio that fits your risk tolerance and financial objectives.

What our clients have to say.

We have been using John for close to 30 years. He is wonderful to deal with and easy to understand. He has set us up for a very comfortable retirement. Thank you, John! Our children are now using him to help them navigate the investment world.

More than Stocks and Bonds. Why Alternative Investments matter.

Alternative investments are assets that fall outside of traditional investments like stocks, bonds, and cash, and generally includes a range of asset classes.

Like adding new players to your investment team, they offer different skills and can help you win more often, defend better when the game gets tough, and make sure you don’t rely on just one player. This way, if one player (or investment) isn’t performing well, the rest of your team can step in to support.

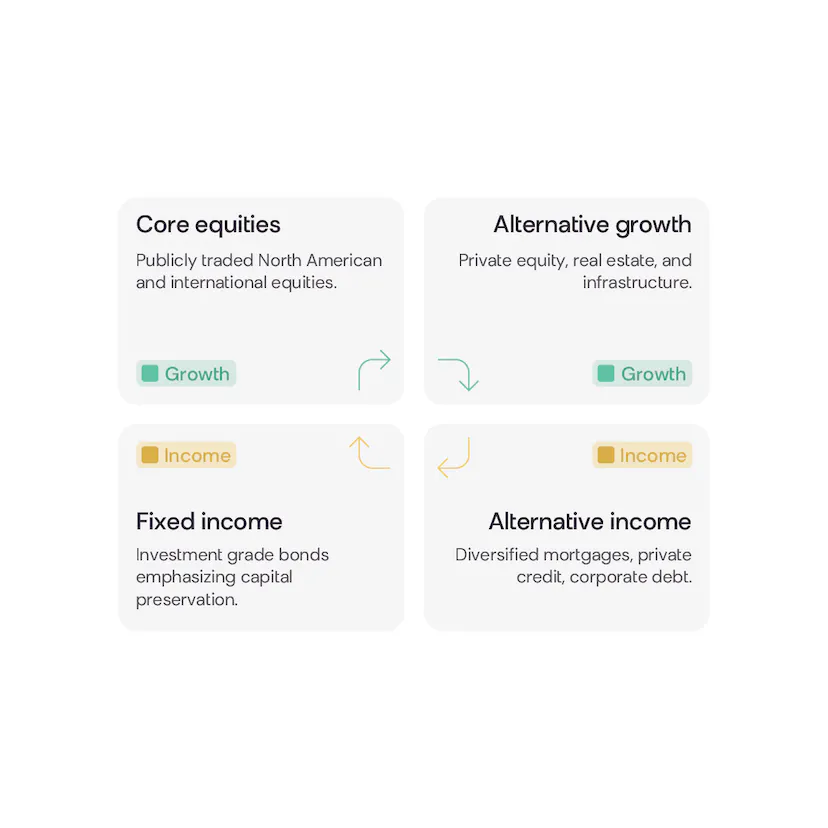

Distinct Diversification Simplified.

Our client-focused strategy includes four proprietary investment pools: Alternative Income, Fixed Income, Alternative Growth, and Core Equities. Each of these pools offers distinct opportunities and plays a unique role in your overall portfolio.

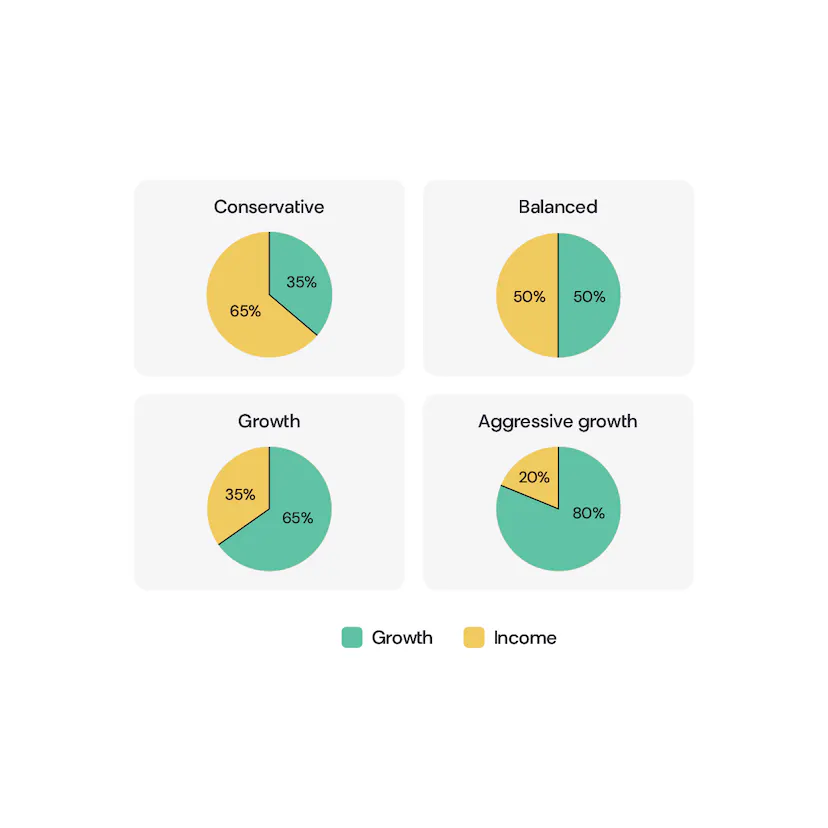

We make investing less about chance and more about choice.

We cater to your various risk tolerances and financial goals by providing four allocation options: Enhanced Income, Tactical Balanced, Enhanced Growth, and Aggressive Growth. These options allow you to strike the perfect balance between risk and return, based on your personal preferences and financial objectives.

At Griffin Private Wealth Management you aren’t just investing your money – you’re shaping your financial future.

Some of Our Trusted Sub-Advisors

The clear path to an elevated investment portfolio.

1. Discovery

We begin by understanding your financial aspirations, risk tolerance, and investment preferences.

2. Advise

Based on your profile and market insights, we craft a personalized investment strategy to grow and protect your wealth.

3. Implement

Putting the strategy into action, we select and manage through WealthCo’s proprietary investment pools.

4. Review

We regularly reassess your investment strategy to ensure it remains in sync with your goals and objectives.

Don't just manage your money. Protect your financial future.

At Griffin Private Wealth Management, we understand that your financial journey is more than just numbers on a screen. It’s about the hard work you’ve put in, the dreams you’re aspiring to, and the legacy you hope to leave behind. We’re here to not only protect and grow your wealth but also to make sure you feel confident and secure about your financial future.

Our unique approach prioritizes extensive diversification, utilizing : Alternative Income, Fixed Income, Alternative Growth, and Core Equities. Based on your risk appetite and financial goals, we craft a bespoke strategy just for you: Enahnced Income, Tactical Balanced, Enhanced Equity, and Aggressive Growth. With Griffin Private Wealth Management, you’re not left to the whims of the market. Instead, you become an empowered investor, choosing the strategy that suits your unique situation and goals.

At Griffin Private Wealth Management we are dedicated to delivering value beyond your portfolio balance. We’re committed to being a reliable partner, working with your other professional advisors, to offer a pension-style investment approach and focusing on downside risk mitigation.

Let us guide you through the complex world of investing, and together we’ll turn your financial dreams into reality. With Griffin Private Wealth Management, your wealth is not just managed—it’s protected, nurtured, and positioned for sustainable growth

Book your free Discovery Meeting.

Interested in learning more about how a pension-style approach can help you achieve your investment goals? Book a Discovery meeting with a team member today.